Happy Yogurt #1: The World vs Japan

Market Shake explores the latest plant-based yogurt category trends.

Hello, Market Shakers!

Today marks the beginning of our Happy Yogurt cycle, dedicated to all the dairy-free silky, creamy, tasty yogurt of our times.

From niche to shadow, plant-based yogurt options are expanding at a rapid pace, with an acceleration since the late 2010s in North America and Europe. Companies are launching innovative products made from nuts, cereals, legumes, or seeds. No longer limited to specialized stores and finding space on mainstream shelves with more flavors than ever before, guilt-free yogurt brands convince more and more consumers.

Without further ado, let’s jump in with a pinch of granola!

Get Market Shake in your inbox every Tuesday:

Summary of this edition:

The plant-based yogurt category is growing fast

Plant-based yogurt trends in the world

Plant-based yogurt trends in Japan

The plant-based yogurt category is growing fast, carried by health and ethical concerns.

In 2020, the dairy alternative market was valued at US$ 22.6 billion and projected to reach US$ 40.6 billion by 2026, “recording a CAGR of 10.3 % in terms of value.” In the United States alone, the plant-based yogurt category growth rate was approximately 20%. That same year, manufacturers focused on improving their production to reduce costs and make plant-based dairy more affordable to mainstream consumers. Gaining a competitive advantage on pricing would help the category catch up with the dairy industry. The market is led by the United States and Europe, where the largest share is held by top-tier players such as Danone.

CHKP Foods Co-founder Sharon Noam kindly shared his view on the market with our CX Manager Polina Arabadzhieva.

Our market studies show very clearly how yogurt is a major pain point for plant-based food consumers. While over 30% of households in the US already tried the existing offering, the actual adoption rate is around 5%. This wide gap is a clear indication that tasty, appealing products can drive the category to massive growth.

The current plant-based yogurt holds about 5% of the total market share in the United States. A few months ago, Danone’s former CEO was quoted as saying that the market share is bound to reach 50% in a few years’ time. We fully and humbly agree with this forecast and are very excited about our prospective share in this revolution — because it is a revolution!

Like for the other plant-based categories (Redefining Meat, Beyond Milk), the shift is carried by a growing interest in vegan and flexitarian diets for ethical and environmental reasons.

Where the mainstream consumer was reluctant to engage in a drastic change, the flexitarian diet offers to cut the apple in half. The rise in lactose intolerance and milk allergy is another factor —consumers are becoming more aware and seek dairy alternatives. Their nutritional value makes plant-based yogurts an attractive choice for consumers looking to cut excess sugar, animal and chemical-sounding ingredients. However, the category is still challenging when it comes to formulation and meeting consumers’ sensory expectations. In short, manufacturers work hard to come up with creamy textures and convincing flavors.

Trends in the world

North America

The region is experiencing a plant-based craze across all categories. The US retail sales of dairy-free yogurt were up 16.4% in the year to February 2021 (SPINS retail data). Let’s have a look at some of the pioneers and more recent start-ups — there are many companies out there, and we had to make some cuts. If you know more great names, feel free to drop them in a comment!

Silk

Plant-based pioneer owned by Danone since 2017, Silk has an extensive portfolio of dairy-free products. Leader in North America, the brand expanded outside of the milk space with the introduction of soy-based yogurts in 2013. In 2019, they expanded into the oat-based yogurt category. Today, they also offer coconut milk, almond milk, and protein nut milk-based yogurt products with various flavors and sizes. In addition, in 2020, the brand launched vegan yogurt for children.

The strength of Silk is that we create plant-based products across a variety of formats — beverage, yogurt alternatives, and creamers. We make it easy for people to adopt a plant-based lifestyle across dayparts, in many different categories.

Domenic Borreli, President, Plant-Based Food and Beverages and Premium Dairy at Danone, Silk is a plant-based products pioneer by Dairy Foods

Forager Project

Organic vegan creamery from California, the Forager Project started producing dairy alternatives in 2013. Today, the family-owned business makes US$20 million in annual revenue and is backed by French-headquartered CPG giant Danone. The Forage Project offers dairy-free milk, yogurt, creams, and more. In 2016, they launched their cashew-based yogurt lineup, which expanded to ice cream in April 2021. Then, in March, they unveiled Cheeseworks, a new line-up of plant-based cheese.

Chobani

Founded 16 years ago in New York, Chobani is now a steady food processing company with US$1.8 billion in annual revenue. Chobani isn’t a predominantly dairy-free brand — they started with Greek yogurt (now fair-trade certified). But in 2019, they launched their vegan line-up with two categories, oat, and coconut. In May 2021, the company announced its launch in South Korea.

Kite Hill

Kite Hill was founded in 2010 and has quite the pedigree, co-founded by Pat Brown, the founder of Impossible Foods. This plant-based ‘artisan’ brand offers a wide range of plant-based yogurts made from almond and coconut. Based in San Francisco, the company is carried by an innovative spirit and regularly brings new products to the market. In June 2021, they announced the launch of vegan queso, made with cultured almond milk to help mimic a creamy dairy texture.

Demand for variety, superior taste and simple ingredients in the non-dairy plant-based market continues to accelerate as consumers actively seek food options that they can feel great about.

Shannon Toyos, Senior Vice President of Marketing, Kite Hill, Kite Hill® Launches Two New Innovative Plant-Based Platforms

Nancy’s

Nancy’s family-owned business goes back to the 60s and is known for being a probiotic pioneer. The small creamery launched the first yogurt in the United States to contain live probiotics in 1970. Over two decades ago, Nancy’s started offering non-dairy yogurt alternatives. In 2019, they announced the nationwide distribution of their oat milk yogurt.

Anita’s

Led by solo female entrepreneur Anita Shepherd, coconut yogurt brand Anita’s operates in Brooklyn since 2013. Since its launch, the brand went from a small kitchen fridge to a warehouse facility. So popular, Anita’s yogurts ranked high in countless top best tasting yogurt. However, in 2018, the company failed to outsource the packaging and labeling processes. Then in 2020, they faced the shift from in-person to online grocery shopping, pushed to find e-commerce partners, and launched their online store.

Lavva

Founded in 2017, Lavva is an alt yogurt and creamer brand made from pili nuts and coconut. In February 2021, the alt-dairy company secured some founding from Australia’s Health and Plant Protein Group and venture fund S2G Ventures.

Daiya

Major brand in North America and beyond, Daiya is a Canada-based alt food company subsidiary of Otsuka Holdings since 2017. Founded in 2008 and known for its vegan cheese, the industry-leading brand has a solid line-up of non-dairy yogurt and ice cream. Daiya was very busy in 2020 — the company greatly expanded its range of products and, in the fall, launched a new advertising campaign, surfing on the growing interest for pant-based foods.

South America

NotCo

Based in Chile, NotCo is a disruptive food-tech company producing plant-based alternatives founded in 2015. Fast-growing, the Chilean start-up uses machine learning to create plant-based substitutes. The data enables the company to develop flavors and textures that are tasty, affordable, healthy, and sustainable. Notably backed by Jeff Bezos, the company raised US$85 million in September 2020. A few months ago, the company launched in the United States, confirming distribution “in more than 3,000 stores in the first half of 2021” and has plans for Mexico, Peru, and Colombia. In July 2021, NotCo “raised $235 million in its latest funding round that also included athletes Lewis Hamilton and Roger Federer, valuing the plant-based food company at $1.5 billion.”

Europe

One of the most dynamic regions, Europe, is experiencing a green boom, with France, Italy, Germany, and the United Kingdom as the biggest markets for plant-based yogurt.

Valsoia

Based in Italy, Valsoia has a wide range of non-dairy alternatives, from yogurt to cheese, ice cream, desserts, spreads, and meat. Founded in 1990, the company is a market leader in the health food segment, with soy-based food production as core business. In March 2020, Valsoia started the distribution of its oat milk-based ice cream in the United States. The Italian food company closed last fiscal year with US$ 99.7 million in revenue (+11.6% from 2019).

Oui by Yoplait

The second largest fresh dairy product company globally, Yoplait, was founded in 1965 in France. General Mills and Sodiaal now own the company. The brand is also number one in the world for fruit yogurts. In 2019, Oui unveiled a coconut-based yogurt planning its launch for early 2020.

There is growing consumer interest in adding plant-based foods into their diets and we want to be able to serve a wide variety of consumers. There are many reasons that drive consumers to purchase dairy-free—some have strongly held beliefs about how dairy impacts the environment or concerns about dairy’s impact on the body, some may have health reasons like dairy intolerance or avoid dairy as part of a weight-loss regimen.

There is also an increasing number of people who consume dairy-based yogurts that are eating both dairy-based and dairy-free options. People are open to experimenting more and trying new things, something we have seen happening across the yogurt category for some time.

Bridget Christenson, Yoplait spokesperson to the VegNews in Yoplait Debuts Dairy-Free Oui Yogurt Line

Meadow Foods

With US$ 400 million in annual revenue, Meadow Foods (1992) is today the largest independently owned dairy group and a leading supplier of ingredients to the food industry in the United Kingdom. In 2020, they invested US$5.5 million in a new plant-based manufacturing facility where they planned the production of non-dairy greek yogurt for 2021.

The Collaborative

Founded by twin brothers in 2014, The Collaborative started off making coconut-based yogurt and desserts in the U.K. Available in retail nationwide, the brand expanded to the United States market in 2018. The start-up closed a US$ 7 million Series A funding round led by PowerPlant Ventures in April 2020. They launched on Amazon Fresh in May 2021.

Oatgurt by Oatly

The Swedish oat milk star Oatly expanded to the drinkable yogurt category in 2019 and greek-style yogurt in 2020. In June 2021, they announced their partnership with NYC frozen yogurt chain 16 Handles.

Branching out our product range even further and launching such a food staple with Oatgurt shows our continued commitment to making it easier for people to switch from dairy to oat.

Ishen Paran, General Manager at Oatly UK

Oceania

Made Group

This Australian beverage company with a focus on coconut water and milk products was founded in 2005. Since then, the company has developed several food product brands, including coconut water and yogurt Cocobella. At the end of 2018, Coca-Cola Amatil and The Coca-Cola Company jointly acquired a 45% minority interest in Made Group.

Raglan

Entrepreneur Latesha Randall (“Mrs. Coconut”) went from her home kitchen in 2014 to a million-dollar factory in 2020. Largest dairy-free yogurt company in New Zealand, the company now supplies over 600 stores in New Zealand, Singapore, Hong Kong, and the Pacific Islands.

I was just making coconut yogurt at home to help with Seb’s dairy allergies. We wanted to eat a dairy-free diet but didn't want to give up yogurt as we both love it, so I found an alternative option. I offered a couple of jars to the Raglan locals to buy and had huge demand, and it just grew organically from there with more and more people asking for it.

Latesha Randall

New Zealand’s Raglan Food Co is an example of success without sacrificing principles

Israel

Yofix Probiotics

Founded in 2019, Yofix Probiotics announced US$ 5 million in annual revenue and raised over US$ 2.5 million in Series A funding in February 2020. The start-up is backed up by Muller Ventures, the French Bel Group, and US financial firm LionTree Partners LLC. Yofix Probiotics develops and manufactures dairy and soy-free fermented plant-based pre & probiotic foods.

CHKP Foods by Planterra

Launched in 2019, Planterra is a disruptive food tech start-up, the first in the world to develop non-dairy products from chickpea protein isolate. Their CHKP Foods brand competes with classic soy, almond, and oat on allergies and sustainability. In addition, they developed proprietary know-how on creating exceptional taste, texture, and nutritional values through hard work and research.

CHKP is preparing to launch its first product in the US market within the coming month. The products are dairy alternatives, comprising milk, yogurt, cream cheese and sweet desserts.

Having based the products on innovative formulations and unique technologies, CHKP will offer consumers a new option that not only has the highest resemblance to actual dairy products in their taste and textured profile – but also is healthier, with reduced levels of sugar, high protein content that boast high nutritional quality.

In addition, chickpeas, who are the source of this protein, are one of the most sustainable agricultural crops, with very low water consumption and superb resilience (which allows very limited use, if at all, of chemicals in its growth cycle). All these combined, are sure to shake the dairy alternatives market.

Asia

Nongfu Spring

Founded in China, Nongfu Spring is a beverage company that goes back to 1996. In 2019, they launched China’s first vegan yogurt brand. Their products are made from walnuts, coconut, and almonds.

Rivon

The Saha Group has distributed the Thai brand Rivon SoYgurt since at least 2016 and is available in retail (including Lawson and Family Mart convenience store chains). They offer vegan probiotic yogurts made from soy.

What are the plant-based yogurt trends in Japan?

A shy but steady growth behind alternative meat and cheese.

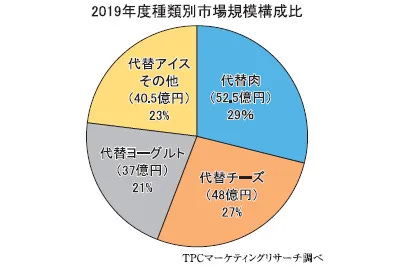

While Japan isn’t going through such a visible revolution, the market for plant-based alternative foods is growing steadily. The non-dairy yogurt category grew 3.7 times between 2009 and 2019, behind the meat category (6.6) and the cheese category (5.3). In 2019, the market size was valued at US$ 33.3 million.

The expansion of non-dairy products is supported by their positive image as healthy foods, more than by the social background of overseas markets. The low-fat and low-calorie calorie characteristics of plant-based protein match consumers' health consciousness seeking to improve the quality of their protein intake. Japanese consumers are also highly conscious about cholesterol —a concern addressed by nearly all the available plant-based yogurt brands.

The entry into the game by major domestic and international players is also stimulating this new demand. We asked CHKP co-founder Sharon Noam what he thinks of the potential of Japan from the perspective of a market entry.

Doing anything substantial in the Japanese market will require bridging many gaps — language, consumer habits, perception of our ingredients within consumers, and much more. We do believe that making the effort to bridge those gaps and approach Japanese consumers with our brand and products should pay off.

From the little that we do know, consumers in Japan are very demanding and have a very high awareness of healthy eating and good nutrition. Our high-quality products meet their needs and should catch their attention. Practically speaking, approaching the Japanese market will require teaming up with a strong local player – and this is something we are definitely looking into.

Sharon Noam, Co-Founder, CEO, CHKP Foods Inc

Who are the main players?

The two main players driving the growth in this category are Pokka Sapporo Food & Beverage, which holds a majority share of the overall market, and Marusan Ai, which holds a majority share of the market for large packaging.

Pokka Sapporo

Pokka Sapporo entered the market in 2003 with the Soy Bio brand, expanding the portfolio over the years. In 2015, they acquired the Kobe-based Toraku soy milk company and took their brand Soya Farm under their wing.

In 2020, Pokka Sapporo’s sales for the soy-based yogurt category reached US$ 18.9 million (+20% compared to the previous year). They had released a new design for their Soy Bio brand with solid success in retail. In the fall of the same year, they launched an advertising campaign tied up with Hello Kitty's popular brand.

Marusan Ai

Marusan Ai saw a 23% increase in sales, reaching up to 50% for their large container of soy-based yogurt produced with domestic soy milk. Interestingly, large containers (400g) are popular with Japanese consumers and gained momentum, according to the Food Journal (in Japanese).

We will work on product design and promotion to improve the recognition of Soy Milk Gurt, including the fact that not only soy milk but also lactic acid bacteria are plant-based, and that it is the top-selling large volume soy milk yogurt. We will also appeal to the fact that we use domestic soybeans.

Marketing Office of Marusan Ai's Development Control Department.

Other players count Fujicco, a plant-based meat manufacturing company, and Kokubu Food Create.

A new entrant in this category, the food manufacturer Fujicco, released a soy-based version of their brand Caspian yogurt in 2020, with a rebranding in March 2021. Another notable player, food wholesaler and manufacturer Kokubu Food Create launched Japan’s first almond-based yogurt in April 2020, disrupting the market with what the company hopes to become an iconic product.

In July 2021, Tokyo-based company Fruta Fruta (re)launched its Coconut Yogurt. Launched a first time under a small format in 2018, the brand had not met success in Japan. The company hopes this new, larger version will meet consumers’ expectations.

See you next Tuesday!

Our next issue takes a closer look at Japanese consumers’ needs and perceptions of dairy-free yogurt. Do they ditch dairies in favor of alternative products? What are the key drivers?

Industry News:

Made with ❤️ by GourmetPro - Food & Beverage experts in Japan.

Reach out for questions and comments!